The Art of Investing: Lessons from History’s Greatest Investors

The Great Courses Living-இன் இலவசச் சோதனையைப் பெறுங்கள் அல்லது வாங்குங்கள்

விதிமுறைகள் பொருந்தும்

எப்பிசோடுகள்

சீ1 எ1 - Investing Skill, Strategy, and Temperament

8 டிசம்பர், 201629நிமிWelcome to a boot camp on investing! Discover the influences that led Professor Longo to a career in finance. Then meet some of the major figures you will study. Survey the key principles and strategies that built their fortunes.The Great Courses Living-இன் இலவசச் சோதனையைப் பெறுங்கள் அல்லது வாங்குங்கள்

8 டிசம்பர், 201629நிமிWelcome to a boot camp on investing! Discover the influences that led Professor Longo to a career in finance. Then meet some of the major figures you will study. Survey the key principles and strategies that built their fortunes.The Great Courses Living-இன் இலவசச் சோதனையைப் பெறுங்கள் அல்லது வாங்குங்கள்சீ1 எ2 - Benjamin Graham and Value Investing

8 டிசம்பர், 201631நிமிMany of the most successful investors of the 20th and early 21st centuries were hugely influenced by the work of Ben Graham, the pioneer of value investing. Study the underpinnings of his proven philosophy, including the contrasting strategies of the enterprising investor and the defensive investor.The Great Courses Living-இன் இலவசச் சோதனையைப் பெறுங்கள் அல்லது வாங்குங்கள்

8 டிசம்பர், 201631நிமிMany of the most successful investors of the 20th and early 21st centuries were hugely influenced by the work of Ben Graham, the pioneer of value investing. Study the underpinnings of his proven philosophy, including the contrasting strategies of the enterprising investor and the defensive investor.The Great Courses Living-இன் இலவசச் சோதனையைப் பெறுங்கள் அல்லது வாங்குங்கள்சீ1 எ3 - Warren Buffett: Investing Forever

8 டிசம்பர், 201629நிமிExplore the celebrated career of Warren Buffett, one of the world's richest people thanks to his disciplined approach to buying and selling companies. Learn how Buffett modified the strategy of his mentor, Ben Graham, by searching out high-quality companies with a competitive advantage, or "moat."The Great Courses Living-இன் இலவசச் சோதனையைப் பெறுங்கள் அல்லது வாங்குங்கள்

8 டிசம்பர், 201629நிமிExplore the celebrated career of Warren Buffett, one of the world's richest people thanks to his disciplined approach to buying and selling companies. Learn how Buffett modified the strategy of his mentor, Ben Graham, by searching out high-quality companies with a competitive advantage, or "moat."The Great Courses Living-இன் இலவசச் சோதனையைப் பெறுங்கள் அல்லது வாங்குங்கள்சீ1 எ4 - Fisher and Price: The Growth-Stock Investors

8 டிசம்பர், 201629நிமிTurn to the fathers of growth investing, Philip Fisher and T. Rowe Price, Jr.. Discover how to tell growth stocks from value stocks. Then learn to spot signs that a stock is worth holding over the very long term, which is the goal of this influential school of portfolio analysis.The Great Courses Living-இன் இலவசச் சோதனையைப் பெறுங்கள் அல்லது வாங்குங்கள்

8 டிசம்பர், 201629நிமிTurn to the fathers of growth investing, Philip Fisher and T. Rowe Price, Jr.. Discover how to tell growth stocks from value stocks. Then learn to spot signs that a stock is worth holding over the very long term, which is the goal of this influential school of portfolio analysis.The Great Courses Living-இன் இலவசச் சோதனையைப் பெறுங்கள் அல்லது வாங்குங்கள்சீ1 எ5 - Harry Markowitz's Modern Portfolio Theory

8 டிசம்பர், 201628நிமிStudy what two Nobel Prize-winning economists have to say about risk. Harry Markowitz put risk on an equal footing with return. Delve into his Modern Portfolio Theory and its implications for investors. Also investigate the insights of William Sharpe's Capital Asset Pricing Model.The Great Courses Living-இன் இலவசச் சோதனையைப் பெறுங்கள் அல்லது வாங்குங்கள்

8 டிசம்பர், 201628நிமிStudy what two Nobel Prize-winning economists have to say about risk. Harry Markowitz put risk on an equal footing with return. Delve into his Modern Portfolio Theory and its implications for investors. Also investigate the insights of William Sharpe's Capital Asset Pricing Model.The Great Courses Living-இன் இலவசச் சோதனையைப் பெறுங்கள் அல்லது வாங்குங்கள்சீ1 எ6 - John Bogle, Index Mutual Fund Pioneer

8 டிசம்பர், 201629நிமிSee the index fund phenomenon from the inside through the career of John Bogle, founder of the Vanguard Group. Consider evidence for and against the Efficient Market Hypothesis, on which index investing is based. Also look into pitfalls to avoid when buying index funds.The Great Courses Living-இன் இலவசச் சோதனையைப் பெறுங்கள் அல்லது வாங்குங்கள்

8 டிசம்பர், 201629நிமிSee the index fund phenomenon from the inside through the career of John Bogle, founder of the Vanguard Group. Consider evidence for and against the Efficient Market Hypothesis, on which index investing is based. Also look into pitfalls to avoid when buying index funds.The Great Courses Living-இன் இலவசச் சோதனையைப் பெறுங்கள் அல்லது வாங்குங்கள்சீ1 எ7 - Small-Cap Stocks: More Risk, More Reward

8 டிசம்பர், 201629நிமிExplore the world of small-cap investing, which targets companies with a market capitalization (outstanding shares times price/share) generally less than a billion dollars. Learn how legendary investors Warren Buffett, Peter Lynch, and Michael Burry flourished in this market. Survey your own options for getting involved.The Great Courses Living-இன் இலவசச் சோதனையைப் பெறுங்கள் அல்லது வாங்குங்கள்

8 டிசம்பர், 201629நிமிExplore the world of small-cap investing, which targets companies with a market capitalization (outstanding shares times price/share) generally less than a billion dollars. Learn how legendary investors Warren Buffett, Peter Lynch, and Michael Burry flourished in this market. Survey your own options for getting involved.The Great Courses Living-இன் இலவசச் சோதனையைப் பெறுங்கள் அல்லது வாங்குங்கள்சீ1 எ8 - John Templeton, Global Treasure Hunter

8 டிசம்பர், 201630நிமிGo stock hunting with John Templeton, who changed the world of finance by focusing on the global market and on a socially responsible portfolio. Review Templeton's checklist of the qualities that make a nation an attractive investing opportunity - for example, a low tax rate and high savings rate.The Great Courses Living-இன் இலவசச் சோதனையைப் பெறுங்கள் அல்லது வாங்குங்கள்

8 டிசம்பர், 201630நிமிGo stock hunting with John Templeton, who changed the world of finance by focusing on the global market and on a socially responsible portfolio. Review Templeton's checklist of the qualities that make a nation an attractive investing opportunity - for example, a low tax rate and high savings rate.The Great Courses Living-இன் இலவசச் சோதனையைப் பெறுங்கள் அல்லது வாங்குங்கள்சீ1 எ9 - David Dreman, Contrarian Money Manager

8 டிசம்பர், 201630நிமிYou are likely to be your own worst enemy when it comes to investing. Find out if you make the common mistakes on market psychologist David Dreman's list. Known as a contrarian - an investor who goes against the crowd - Dreman made a fortune by bucking trends.The Great Courses Living-இன் இலவசச் சோதனையைப் பெறுங்கள் அல்லது வாங்குங்கள்

8 டிசம்பர், 201630நிமிYou are likely to be your own worst enemy when it comes to investing. Find out if you make the common mistakes on market psychologist David Dreman's list. Known as a contrarian - an investor who goes against the crowd - Dreman made a fortune by bucking trends.The Great Courses Living-இன் இலவசச் சோதனையைப் பெறுங்கள் அல்லது வாங்குங்கள்சீ1 எ10 - Peter Lynch: Invest in What You Know

8 டிசம்பர், 201628நிமிStudy mutual funds through the career of Peter Lynch of Fidelity, renowned for his spectacular management of the Magellan Fund in the 1980s. Discover the meaning of key mutual fund terms, and learn how Lynch picked winners. His famous mantra, "Invest in what you know," is only part of the formula.The Great Courses Living-இன் இலவசச் சோதனையைப் பெறுங்கள் அல்லது வாங்குங்கள்

8 டிசம்பர், 201628நிமிStudy mutual funds through the career of Peter Lynch of Fidelity, renowned for his spectacular management of the Magellan Fund in the 1980s. Discover the meaning of key mutual fund terms, and learn how Lynch picked winners. His famous mantra, "Invest in what you know," is only part of the formula.The Great Courses Living-இன் இலவசச் சோதனையைப் பெறுங்கள் அல்லது வாங்குங்கள்சீ1 எ11 - The Bond Kings: Bill Gross, Jeffrey Gundlach

8 டிசம்பர், 201630நிமிMany people have an intuitive understanding of stocks but are at a loss when it comes bonds. Get a grip on this vital investment vehicle by probing the strategies of two contemporary bond kings: Bill Gross and Jeff Gundlach. Consider the best way to use bonds in your own portfolio.The Great Courses Living-இன் இலவசச் சோதனையைப் பெறுங்கள் அல்லது வாங்குங்கள்

8 டிசம்பர், 201630நிமிMany people have an intuitive understanding of stocks but are at a loss when it comes bonds. Get a grip on this vital investment vehicle by probing the strategies of two contemporary bond kings: Bill Gross and Jeff Gundlach. Consider the best way to use bonds in your own portfolio.The Great Courses Living-இன் இலவசச் சோதனையைப் பெறுங்கள் அல்லது வாங்குங்கள்சீ1 எ12 - Sovereign Wealth Funds: Singapore

8 டிசம்பர், 201631நிமிSovereign wealth funds are investment portfolios owned and managed by the government, generally in countries with commodity-oriented economies or large trade surpluses, such as Saudi Arabia and Singapore. Examine the history of these funds, how they operate, and their increasingly important role in the global economy today.The Great Courses Living-இன் இலவசச் சோதனையைப் பெறுங்கள் அல்லது வாங்குங்கள்

8 டிசம்பர், 201631நிமிSovereign wealth funds are investment portfolios owned and managed by the government, generally in countries with commodity-oriented economies or large trade surpluses, such as Saudi Arabia and Singapore. Examine the history of these funds, how they operate, and their increasingly important role in the global economy today.The Great Courses Living-இன் இலவசச் சோதனையைப் பெறுங்கள் அல்லது வாங்குங்கள்சீ1 எ13 - The First Hedge Fund: A. W. Jones

8 டிசம்பர், 201630நிமிTake the mystery out of hedge funds with A.W. Jones, the sociologist who started the modern hedge fund industry. Jones designed a fund that smoothed out the rollercoaster ride of traditional buy-and-hold investing by offsetting long purchase positions with short sale positions.The Great Courses Living-இன் இலவசச் சோதனையைப் பெறுங்கள் அல்லது வாங்குங்கள்

8 டிசம்பர், 201630நிமிTake the mystery out of hedge funds with A.W. Jones, the sociologist who started the modern hedge fund industry. Jones designed a fund that smoothed out the rollercoaster ride of traditional buy-and-hold investing by offsetting long purchase positions with short sale positions.The Great Courses Living-இன் இலவசச் சோதனையைப் பெறுங்கள் அல்லது வாங்குங்கள்சீ1 எ14 - Activist Investors: Icahn, Loeb, Ackman

8 டிசம்பர், 201630நிமிGo company hunting with activist investors, sometimes called corporate raiders. Chart the exploits of three leading practitioners: Carl Icahn, Dan Loeb, and Bill Ackman. Along the way, learn the meaning of terms such as greenmail, black knight, white knight, shark repellant, and Pac-Man strategy.The Great Courses Living-இன் இலவசச் சோதனையைப் பெறுங்கள் அல்லது வாங்குங்கள்

8 டிசம்பர், 201630நிமிGo company hunting with activist investors, sometimes called corporate raiders. Chart the exploits of three leading practitioners: Carl Icahn, Dan Loeb, and Bill Ackman. Along the way, learn the meaning of terms such as greenmail, black knight, white knight, shark repellant, and Pac-Man strategy.The Great Courses Living-இன் இலவசச் சோதனையைப் பெறுங்கள் அல்லது வாங்குங்கள்சீ1 எ15 - The Big Shorts: Livermore, Chanos

8 டிசம்பர், 201629நிமிShort selling is a dangerous game, since your losses are theoretically unlimited. Compare the short-selling strategies of two investing legends: Jesse Livermore, who made millions during the crash of 1929, and James Chanos, who predicted the collapse of Enron in the early 2000s.The Great Courses Living-இன் இலவசச் சோதனையைப் பெறுங்கள் அல்லது வாங்குங்கள்

8 டிசம்பர், 201629நிமிShort selling is a dangerous game, since your losses are theoretically unlimited. Compare the short-selling strategies of two investing legends: Jesse Livermore, who made millions during the crash of 1929, and James Chanos, who predicted the collapse of Enron in the early 2000s.The Great Courses Living-இன் இலவசச் சோதனையைப் பெறுங்கள் அல்லது வாங்குங்கள்சீ1 எ16 - George Soros's $10 Billion Currency Play

8 டிசம்பர், 201631நிமிGeorge Soros, financier and philosopher, made more than a billion dollars in one day by following his own advice to bet big if you have high confidence in an idea. Trace the saga of this man's eventful life, from Nazi-occupied Hungary to the world stage, from social science theorist to global macro trader.The Great Courses Living-இன் இலவசச் சோதனையைப் பெறுங்கள் அல்லது வாங்குங்கள்

8 டிசம்பர், 201631நிமிGeorge Soros, financier and philosopher, made more than a billion dollars in one day by following his own advice to bet big if you have high confidence in an idea. Trace the saga of this man's eventful life, from Nazi-occupied Hungary to the world stage, from social science theorist to global macro trader.The Great Courses Living-இன் இலவசச் சோதனையைப் பெறுங்கள் அல்லது வாங்குங்கள்சீ1 எ17 - Bridgewater's Multi-Strategy Investing

8 டிசம்பர், 201629நிமிLearn from the successes of Ray Dalio, founder of Bridgewater, one of the world's largest hedge funds. Among his coups, the firm's Pure Alpha Fund gained almost 10% during the financial crisis in 2008, while U.S. and global stocks fell by 35% or more. Focus on Dalio's global macro and multi-strategy.The Great Courses Living-இன் இலவசச் சோதனையைப் பெறுங்கள் அல்லது வாங்குங்கள்

8 டிசம்பர், 201629நிமிLearn from the successes of Ray Dalio, founder of Bridgewater, one of the world's largest hedge funds. Among his coups, the firm's Pure Alpha Fund gained almost 10% during the financial crisis in 2008, while U.S. and global stocks fell by 35% or more. Focus on Dalio's global macro and multi-strategy.The Great Courses Living-இன் இலவசச் சோதனையைப் பெறுங்கள் அல்லது வாங்குங்கள்சீ1 எ18 - Paul Tudor Jones, Futures Market Seer

8 டிசம்பர், 201630நிமிStudy the investment strategy of Paul Tudor Jones, the man who predicted the stock market crash of 1987. Since then, his hedge fund firm, Tudor Investment, has been an industry leader. Focus on Jones's background in futures trading and his savvy use of technical analysis and market psychology.The Great Courses Living-இன் இலவசச் சோதனையைப் பெறுங்கள் அல்லது வாங்குங்கள்

8 டிசம்பர், 201630நிமிStudy the investment strategy of Paul Tudor Jones, the man who predicted the stock market crash of 1987. Since then, his hedge fund firm, Tudor Investment, has been an industry leader. Focus on Jones's background in futures trading and his savvy use of technical analysis and market psychology.The Great Courses Living-இன் இலவசச் சோதனையைப் பெறுங்கள் அல்லது வாங்குங்கள்சீ1 எ19 - James Simons: Money, Math, and Computers

8 டிசம்பர், 201632நிமிTrace the stellar financial career of mathematician and former cryptographer James Simons, who tackled a challenge more difficult than code-breaking: consistently beating the market. Learn how "quants" such as Simons use computer algorithms to model security prices and execute lightning-fast trades.The Great Courses Living-இன் இலவசச் சோதனையைப் பெறுங்கள் அல்லது வாங்குங்கள்

8 டிசம்பர், 201632நிமிTrace the stellar financial career of mathematician and former cryptographer James Simons, who tackled a challenge more difficult than code-breaking: consistently beating the market. Learn how "quants" such as Simons use computer algorithms to model security prices and execute lightning-fast trades.The Great Courses Living-இன் இலவசச் சோதனையைப் பெறுங்கள் அல்லது வாங்குங்கள்சீ1 எ20 - Distressed-Asset Investors: Tepper, Klarman

8 டிசம்பர், 201629நிமிFor the intrepid investor, there are potential riches to be made when companies go under. Explore the field of distressed investing through the successes of two masters: David Tepper and Seth Klarman. Learn how to seize opportunities by buying what others don't want or must sell under duress.The Great Courses Living-இன் இலவசச் சோதனையைப் பெறுங்கள் அல்லது வாங்குங்கள்

8 டிசம்பர், 201629நிமிFor the intrepid investor, there are potential riches to be made when companies go under. Explore the field of distressed investing through the successes of two masters: David Tepper and Seth Klarman. Learn how to seize opportunities by buying what others don't want or must sell under duress.The Great Courses Living-இன் இலவசச் சோதனையைப் பெறுங்கள் அல்லது வாங்குங்கள்சீ1 எ21 - Motorcycles, Gold, and Global Commodities

8 டிசம்பர், 201630நிமிTravel with the commodities specialist dubbed "the Indiana Jones of finance." Since retiring from the Quantum Fund at age 37, Jim Rogers has toured the world, scouting out opportunities in emerging markets. Learn how to break into commodities trading, and get Rogers' tips on what to look for in a foreign market.The Great Courses Living-இன் இலவசச் சோதனையைப் பெறுங்கள் அல்லது வாங்குங்கள்

8 டிசம்பர், 201630நிமிTravel with the commodities specialist dubbed "the Indiana Jones of finance." Since retiring from the Quantum Fund at age 37, Jim Rogers has toured the world, scouting out opportunities in emerging markets. Learn how to break into commodities trading, and get Rogers' tips on what to look for in a foreign market.The Great Courses Living-இன் இலவசச் சோதனையைப் பெறுங்கள் அல்லது வாங்குங்கள்சீ1 எ22 - Private Equity Innovators: KKR, Blackstone

8 டிசம்பர், 201631நிமிTurn to private equity and leveraged buyouts (LBOs), exploring notable deals by two stars of field: Henry Kravis and Stephen Schwarzman, including Kravis's famous takeover of RJR Nabisco in 1988. Though you may never do an LBO yourself, you can invest in private equity firms that are publicly traded.The Great Courses Living-இன் இலவசச் சோதனையைப் பெறுங்கள் அல்லது வாங்குங்கள்

8 டிசம்பர், 201631நிமிTurn to private equity and leveraged buyouts (LBOs), exploring notable deals by two stars of field: Henry Kravis and Stephen Schwarzman, including Kravis's famous takeover of RJR Nabisco in 1988. Though you may never do an LBO yourself, you can invest in private equity firms that are publicly traded.The Great Courses Living-இன் இலவசச் சோதனையைப் பெறுங்கள் அல்லது வாங்குங்கள்சீ1 எ23 - Four Women Who Moved Financial Markets

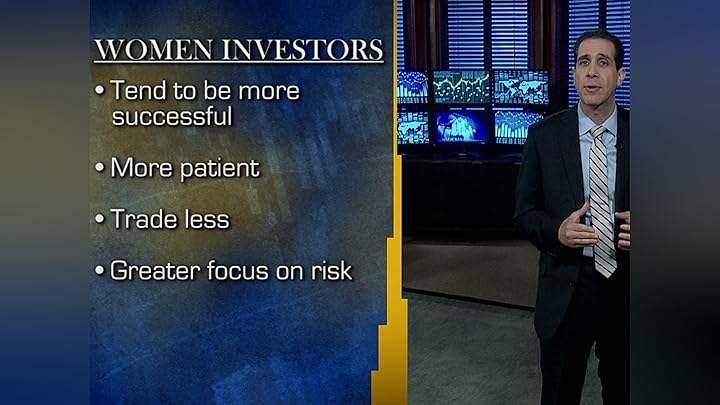

8 டிசம்பர், 201631நிமிOn average, women are better investors than men, with the patience, self-control, and risk-consciousness that are crucial to success in the financial world. Study four female top investors: Hetty Green, Linda Bradford Raschke, Sonia Gardner, and Leda Braga - each with a different approach to building wealth.The Great Courses Living-இன் இலவசச் சோதனையைப் பெறுங்கள் அல்லது வாங்குங்கள்

8 டிசம்பர், 201631நிமிOn average, women are better investors than men, with the patience, self-control, and risk-consciousness that are crucial to success in the financial world. Study four female top investors: Hetty Green, Linda Bradford Raschke, Sonia Gardner, and Leda Braga - each with a different approach to building wealth.The Great Courses Living-இன் இலவசச் சோதனையைப் பெறுங்கள் அல்லது வாங்குங்கள்சீ1 எ24 - Becoming a Great Investor

8 டிசம்பர், 201634நிமிSurvey the shifting fortunes of one famous company that over the course of a century made it appeal to almost every type of investor covered in this course. Then go through a detailed checklist that reveals the investment approach that matches your outlook and resources. Finish with one final great investor!The Great Courses Living-இன் இலவசச் சோதனையைப் பெறுங்கள் அல்லது வாங்குங்கள்

8 டிசம்பர், 201634நிமிSurvey the shifting fortunes of one famous company that over the course of a century made it appeal to almost every type of investor covered in this course. Then go through a detailed checklist that reveals the investment approach that matches your outlook and resources. Finish with one final great investor!The Great Courses Living-இன் இலவசச் சோதனையைப் பெறுங்கள் அல்லது வாங்குங்கள்